Mezzanine Development Finance

Mezzanine development finance or Mezzanine loan provides a second layer of debt finance (debt with a 2nd position lien also known as Junior Mortgages).

It is provided to bridge the gap between the level of senior debt finance (typically going up to 60%) and the developer’s or the investor’s equity investment into the project or the purchase; a second charge usually secures it.

The Mezzanine piece size is typically between 20%-30% of the loan value. Mezzanine development finance reduces the burden on current cash flow and thus helps the project sponsor to manage his finance as well as his actual liquidity.

The Mezzanine loan takes up between 20%-30% of the financing that the borrower must have to realise his project.

We at property finance partners analyse and present the whole picture to our client.

We concentrate on the entire lifetime of the project from the beginning till the end and focus specifically on the timing that the finance is needed.

The mezzanine loan is easier to manage. In most of the loan agreements the mezz piece can be paid or regularly or by rolling up to the loan balance and being paid at the end of the project after the capital loan, it reduces the burden of the ongoing cash flow during the project life.

It is important for the borrower to be able to make a professional comparison, among all the lenders that offer mezzanine loans.

Not all the mezzanine loans are the same and have the same conditions, however, above all there are issues like flexibility and customer service that you cannot measure them with numbers, but only from your personal experience.

We always provide our clients with a professional, honest and transparent opinion about each offer and an opinion about other issues that they cannot see in the numbers and the written offer.

There are cases that its worth to pay a slightly higher interest rate but to get a real strategic finance partner that will be beside you all the way until the successful completion of the project and afterwards for different projects in the future.

CONTENTS

WHAT IS MEZZANINE DEVELOPMENT FINANCE?

Examples Of Mezzanine Development Finance

The Benefits of Mezzanine Financing

Importance Of Mezzanine Development Finance

The Stages Of Firms Preferably Appropriate For Mezzanine

HOW MEZZANINE DEVELOPMENT FINANCE WORKS

Advantages Of Mezzanine Finance

Disadvantages Of Mezzanine Financing

WHO THE MEZZANINE DEVELOPMENT FINANCE IS FOR?

WHAT ARE THE CONDITIONS TO GET THEM?

WHAT ARE THE KEY FEATURES OF MEZZANINE?

What Details Do You Need To Advance A Loan From The Mezzanine?

WHAT IS MEZZANINE DEVELOPMENT FINANCE?

Business funding is divided into three basic classes. The most common, “debt funding” is the name used for financing when you borrow money (undertake debt) at an agreed interest rate.

“Equity funding” you can provide part of your business in exchange for finances.

The third category is called the “mezzanine development financing”, which provides a certain balance between the other two.

Mezzanine Development Finance is a funding mechanism used predominantly by project developers to finance part of the expense of building development projects.

It is a mixture of debt and equity funding that allows lenders the right to turn into company equity in the event of defaults that typically arise after paying venture capital firms and other senior lenders.

Mezzanine financing is used as a “top-up” fund linking up the gap between the deposit available to the developer and the loan available to the senior lender.

Although senior debt can usually provide up to 65% of the GDV or 80% of the project cost, the mezzanine lender will bear up to 90% of the project cost, which means that the developer must bear 10% of the project cost.

Please note that, because the second legal fee is secured by the mezzanine funding and the volume of the loan is higher, the expense is higher than the priority debt.

Project developers can achieve the highest return on investment with the lowest deposit fees by using mezzanine financing to supplement their borrowing.

This funding method is typically used to reduce the volume of deposit required for real estate development projects. Funds may be used to decrease deposits, provide funds for gaps in deposits, or allow you to retain funds for future transactions.

KEYWORDS:

- Mezzanine funding is a means for companies to raise funds from a hybrid of debt and equity funding to facilitate a single project or to facilitate acquisitions.

- Compared with typical corporate debt, this form of funding could provide greater returns, usually 12% to 20% annually.

- Mezzanine loans are more commonly used to extend existing companies, rather than for start-up or early-phase funding.

Other key points about mezzanine finance include:

- Subordinate to senior debt, i.e. loans with the second charge.

- Mezzanine financing is usually secured with second charge or agreement..

- It involves part of the fixed interest and part of the variable interest.

- Can be used as a supplement to or “supplemental” funds provided by the main lender.

- Help companies with valuable equity to seek large amounts of financing to help them get the greatest return.

Examples Of Mezzanine Development Finance

First Example

Bank A (for example) provides mezzanine funds to real estate development company B for 2 million GBP.

The financing are in addition to a senior loan of 10m. The total cost of the development is 13.5m therefore, in total the development company will get 89% loan to cost.

Then, Bank A will charge higher interest for the 2m, and if the company defaults, it will have the right to convert into equity.

Second Example

A property developer wants to convert an office building with PD Rights to residential flats.

The project is a profitable project with a gross development value (GDV) of £ 24,000,000.

His total costs (purchase and development) are £ 20,000,000

A senior lender agrees to lend him only £ 12,250,000, 61.25% loan to cost (Ltc).

He then approaches a Mezzanine lender that will give him £ 4,750,000

The total loans that he has borrowed is equal to 85% loan to cost of the project.

With a combined debt of £ 17,000,000, the developer needs only to contribute 15% of the total costs to realise the project.

There are also other types of property finance that involve an equity piece, and then the combined loan can be up to 100% development finance, (100% loan to cost).

Why Mezzanine Finance?

Mezzanine financing is typically used in situations where if the potential risk is so high that the lender cannot raise enough funds through traditional commercial loans.

The other option is usually equity financing-but many companies wouldn’t want to give up the shares in their businesses.

So, Mezzanine financing enables such companies to borrow greater sums, and if things go according to plan, they will be repaid with profits. In short, this encourages higher investment for higher returns.

In some cases, Mezzanine funding can be repaid in a single lump sum and, in other cases, interest payments can be postponed.

Mezzanine finance can also have tax-deductible interest. Both of these variables make the funding of mezzanines distinct from normal commercial loans.

The Benefits of Mezzanine Financing

- Mezzanine financing is used as a “top-up”, together with the amount the main lender provided.

For example, if the main lender provides 65% of the funds required for the project, then mezzanine financing may provide another 20% of the funds, leaving only 15% of the funds for business Or, Mezzanine financing is a way to raise more funds from the same fund you invest in yourself.

It is usually a facilitator of bigger projects that companies cannot afford.

The consequence of this setting is that companies will make the greatest return by using their available cash investments.

For any company, the working capital level is very critical, so mezzanine funding would definitely be a welcome addition to standard financing arrangements.

- Mezzanine funding is used in leveraged buyouts to finance the purchase price of purchased firms and other securities.

Mezzanine capital will usually be used to fill the funding gap between cheaper financing modes (such as senior loans, second lien loans, high-yield financing) and equity.

Usually, before pursuing mezzanine money, the financial guarantor would exhaust other capital sources.

- Appropriate Financial sponsors will aim to use mezzanine funds in leveraged acquisitions to reduce the volume of capital spent by private equity firms; since the target cost of capital of mezzanine lenders is usually lower than that of private equity investors, the use of mezzanine capital can potentially increase private equity, the company’s return on investment.

Also, due to higher minimum size requirements, mid-market companies may not be able to enter the high-yield market, and therefore require flexible private mezzanine capital.

- Developers also use mezzanine loans for real estate financing to secure additional financing for development projects (usually when the main mortgage or building loan equity requirements are greater than 10%).

Typically, these types of mezzanine loans are backed by second-rate mortgages on real estate (i.e. mortgages subordinated to the first mortgage lender).

Based on the first mortgage lender’s relationship with the mezzanine debt lender, which is controlled by the Inter creditor contract.

Importance Of Mezzanine Development Finance

- Ideal for firms that can’t go public:

As long as the business has a strong track record, positive cash flow or current assets, and a competent management team, the mezzanine can provide the necessary funding without giving up control or significant ownership. - Boost the credit rating of the company:

In the end, the use of mezzanine financing in the capital structure of a company will increase the ability to use conventional bank debt financing.

The debt generated by mezzanine loans is known as “subordinated debt” and is considered to be largely equal to the increase in banks’ and other traditional borrowers’ equity.

The equity/debt ratio is more advantageous and can increase the credit rating of the firm. - Diversified sources of financing:

Mezzanine lenders can assist entrepreneurs to diversify their banking relationship, thereby becoming a reserve capital source and reducing dependency on any lender. - Lowers financing costs:

The rate of return on mezzanine financing is higher than the rate of return on senior debt but lower than the rate of return on equity.

The goal of mezzanine investors is usually 15-25% internal rate of return, while the goal of equity investors is more than 25%. - Enable more flexibility:

While mezzanine debt is more costly than bank debt, the rigidity level is not strict. Usually, mezzanine finance has similar arrangements with bank loans, but the terms may be more versatile. - Enhances other terms and conditions of loans:

Banks usually value firms funded by institutional investors, such as Mezzanine lenders or private equity stores increased participation, this may lead them to expand their credit lines on more favourable terms.

The Stages Of Firms Preferably Appropriate For Mezzanine Finance

- Young Firm with Fast Growth:

In the early stages of growth, a young, high-growth company that uses venture capital may decide to use mezzanine funding as expansion capital to be more beneficial.

As mezzanine funding is cheaper than equity funding, it reduces financing costs and reduces the concerns of entrepreneurial ownership dilution and loss control that usually accompany venture capital financing.

- Established firms with emerging growth opportunities:

A substantial percentage of small to medium-sized high-growth firms are not ‘start-ups’ that have recently expanded exponentially, but existing firms that have found new parts of the industry.

To attract venture capital investment, each of these companies may not have the correct profile, or the projected return rate may be relatively high but may be sufficient to attract venture capital.

- Transitioning and reforming companies:

Mezzanine finance will help turn businesses undergoing transformations and restructuring from a closed family business to an open organization with competent management.

Ultimately, the strategy could lead to a sale to established executives or an outside management company it can also expect an increase in entrepreneur’s equity and “cash expenditure”.

Mezzanine finance is very suitable to support the spin-off of some parts of businesses.

- Firms in need of strengthening of capital structure:

Mezzanine financing can solve the financing constraints faced by over-leveraged small and medium-sized enterprises (especially family businesses), and can reduce the risk exposure of small and medium-sized enterprises.

In the past, companies with weak capital have been maintaining debt financing channels based on good relationships with banks.

Nevertheless, several businesses have been pushed into increasing their dependence on credit and/or government guarantees since the recent financial crisis and thus needed a way to build their capital structure.

- The LBOs:

Mezzanine funding is typically paired with a leveraged buy-out (LBO). Leveraged buyout refers to a transaction involving companies or assets purchased through equity or large amounts of borrowed funds.

The structure uses the cash flow of the target company as collateral to guarantee and repay the borrowed funds. Many mezzanine transactions are carried out on the procurement market in most countries.

Mezzanine Debt? Mezzanine debt arises when the same issuer subordinates a mixed debt issue to another debt issue.

Mezzanine debt comes with embedded equity instruments, commonly referred to as warrants, which can raise the value of subordinated debt and make negotiating with bondholders more flexible.

KEYWORDS

- Mezzanine debt refers to a mixed debt issuance subordinate to another debt issuance.

- Mezzanine debt is one of the riskiest debt-suspended types, it crosses the gap between debt and equity funding.

- Mezzanine debt is more like a stock than debt because build-up options make it very tempting to turn the debt into stock.

Mezzanine Forms Of Debt

Different kinds of equity can be included in the debt. Examples of integrated options include inventory calls, rights, and warrants.

Mezzanine debt is more of a stock than debt, as the embedded options make it very attractive to turn the debt into stock.

HOW MEZZANINE DEVELOPMENT FINANCE WORKS

So, how does the Mezzanine development finance work? Firstly, you need to know that Mezzanine financing is simply a business loan.

After a designated time, the debt can be converted into equity. This implies that if the company could not repay the funds, the lender will receive a fraction of the equity. In this way, the equity in the business can be used as a guarantee.

Mezzanine finance bridges the gap between the financing of debt and equity and is one of the most volatile types of debt.

Priority prevails over pure equity, but less than pure debt. However, this implies that compared to other debt types, it often provides some of the highest returns, as its annual yield is generally between 12% and 20%and often even as high as 30%.

In the short to medium term, the firm will then pursue mezzanine capital to finance growth ventures or assist in acquisitions.

These loans would usually be issued by long-term investors and current investors in the capital of the company.

The arrangement of mezzanine loans has several other characteristics. Mezzanine loans, for example, are subordinated to senior debt yet have precedence to both the preferred and the common shares. Their returns are greater than ordinary debt. Generally, they are unsecured debt.

KEYWORDS

- Mezzanine loans are subjugated to senior debt, but the priority exists over preferred and common stock.

- They are more profitable than ordinary debt.

- Often these are unsecured liabilities

- No debt principal depreciation is probable.

- It may have a fixed component and variable component interest framework.

For Example:

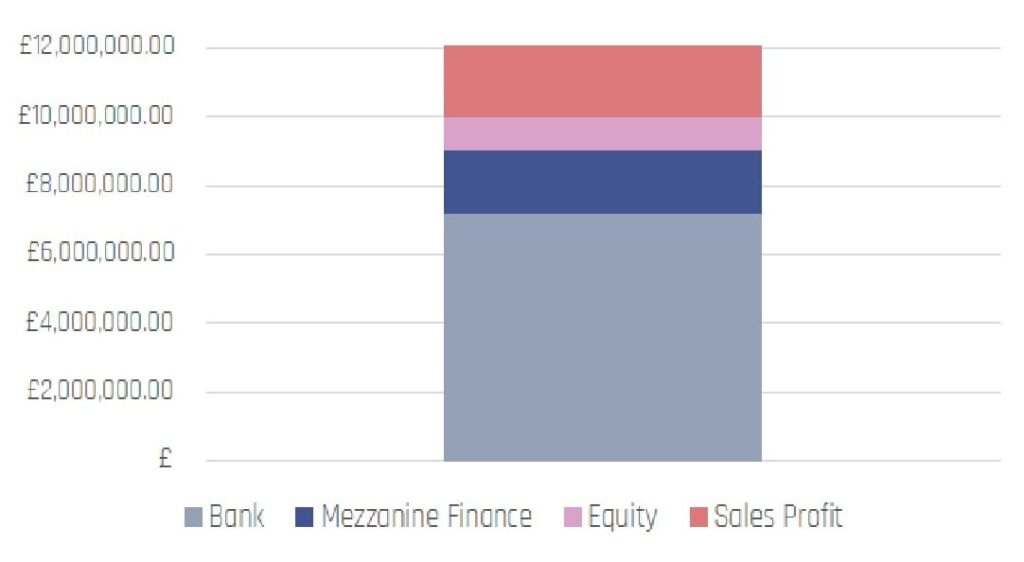

Mezzanine Finance: Typical Structure

(Assuming a total build cost of £10m and GDV of £12m)

Let’s say a development project will cost in total £10M.

The estimated value of the development project is worth £12million until finished.

When the properties are leased, the profit generated makes it work for everyone.

In this scenario, the creator pays 15% (1.5 million Pounds) of the bill. They are at their first defeat

The bank normally pays up to 75% of building costs, or 60% of GDV (we have presumed senior debt is 7.2million Pounds, in this example) based on its funding conditions for on-going growth.

In this example, the disparity between the bank lending as a senior loan provider and the developer’s equity is 1.3 million GBP.

This is the gap filled by mezzanine finance. And since you have a second legitimate fee and are sat behind the bank as your money is charged, it may be a greater risk and helps you to receive higher returns.

Only after you collect your capital and interest due will the developer benefit. We always need personal assurances from the directors as an additional safeguard.

Advantages Of Mezzanine Finance

- Mezzanine financing may cause the lender (or investor) to obtain corporate equity or warrants to purchase equity in the future, and this will greatly boost the rate of return of the investor (ROR).

In addition, the mezzanine financing provider receives monthly, quarterly, or yearly interest payments as stipulated in the contract.

- Mezzanine debt is favoured by borrowers since the interest is tax-deductible. Similarly, it is simpler to handle mezzanine funding than other debt arrangements because interest in the loan balance may be included by the borrower.

Any or all of the interest can be postponed if the creditor fails to pay the interest on time. For other forms of debt, this choice is usually not suitable.

- In addition, the value of fast-growing companies continues to grow, and the reorganization of mezzanine financing into a high-level loan with a low-interest rate that can save interest costs in the long run.

Disadvantages Of Mezzanine Financing

- However, the owner loses leverage and upside opportunities as a result of a lack of equity when it receives mezzanine funds.

The longer the intermediate funding is, the higher the interest charged by the owner.

WHO THE MEZZANINE DEVELOPMENT FINANCE IS FOR?

Mezzanine capital in finance is any sub allowed debt or preferred equity tool that pays for the debt of an asset of a business that is preferred to common stock only.

The structure of mezzanine financing is usually debt.

Compared with secured debt or senior debt, mezzanine capital is usually a more expensive source of financing for companies.

In the event of defaults, mezzanine finance is only possible if all senior debt has been repaid until satisfaction.

The explanation is because the increased cost of equity associated with mezzanine finance is that mezzanine funding is the product of unsecured, subordinate (or primary) debt in the company’s capital structure.

WHAT ARE THE CONDITIONS TO GET THEM?

- Developers must have the expertise to access mezzanine finance utilizing a second charge.

- Informed permission must be given for the planning process.

- The Senior Lender’s appraisal report & QS / MS reports can also be used and addressed to the Mezzanine Lenders.

- Available in England, Scotland, and Wales for residential and real estate development scheme.

- Personal Guarantees will be required

WHAT ARE THE KEY FEATURES OF MEZZANINE?

- Lending up to 75% of the Total Development Volume, or

- Acceptable Loans of up to 90% of overall project costs (including financial costs).

- The Mezzanine Financing Provider Agreement Fees shall be paid case by case and begin with 1 percent.

- Mezzanine financing interest rates will start from 15% per year.

- The exit fees are substantially charged, but still, case by case.

- The minimum mezzanine loan value is £100,000, with no overall loan value.

- No profit-sharing is usually expected for mezzanine loans.

- Available in large systems for up to 36 months.

What Details Do You Need To Advance A Loan From The Mezzanine?

- Applicant Info, and business name & number.

- CV’s or experience information of directors & shareholders

- Site Creation address.

- Info of the senior lender and a copy of the senior debt bid.

- Copy of the planning approval.

- Detailed financial measurement and cash balance.

- Detailed cost of building /quote.

- Schedule of facilities.

- Complete details of the expertise (contractor, architect, structural engineer, CDM coordinator, etc.)

- Form of acquisition. For instance, Design & Build or Construction Management.

- Comparable Sales information (or judgment of the agent) to help the GDV.

To find out how we can help, call today on 020 3393 9277